I received such a great response for my last essay about marketplaces, Not All Marketplaces are Created Equal: Tales from a Marketplace Founder, that I was inspired to write some more! I talked about all the things that make a marketplace attractive for disruption, now I’d like to dig deeper into how to find the right one to go after.

I’m making the assumption that you want to build a huge company that would require raising venture capital to grow and scale, which may not necessarily be for everyone. There are plenty of valid reasons to go after a niche space that can sustain a great business. If you go down the path of trying to fundraise and you can’t hit the necessary hurdles to justify investment, you will have sacrificed a lot of blood, sweat and tears for nothing. More than 60% of startups shut down because their fundraising stalls before the Series A.

Here are the six key questions to answer when deciding which marketplace to build:

- Is the market big enough?

- Is it a crowded space?

- Is it ripe for modernization?

- Can you be easily disintermediated?

- Is the revenue model viable?

- Are there things you can leverage to grow and scale?

1. Is the Market Big Enough?

Size Does Matter

All too often, people are so excited about their idea that they ignore evaluating the size of the potential opportunity before chasing after it. Choosing to pursue a space with a TAM (total addressable market) that is too small will limit your upside potential. One of the problems is when you focus too much on the T (total) and not enough on the A (addressable).

For example, a market like the automobile industry could be huge, but if you are launching a minivan company, then you’re only addressing families. This is only a portion of the market and your TAM is much smaller than the entire automobile industry. On top of that, your SAM (serviceable addressable market) or what you can actually capture is only a slice of that TAM and even smaller. Don’t delude yourself into believing your TAM is bigger than it really is. Investors will call you out and at some point you will not be able to raise any more capital if your TAM is too small, because the potential outcome will not justify their investment. Oftentimes a marketplace requires adequate capital to scale before the flywheel takes effect. Flywheel effects as artfully defined by Eric Jorgenson are positive feedback loops that build momentum, increasing the payoff of incremental effort. If you can’t raise enough to buy time to get there, you’re dead in the water.

Consider two examples of fragmented industries with huge potential: daycares and construction. Over the past five years, the day care industry in the US has grown by 3.2% to reach revenue of $53 billion in 2018 (IBISWorld) and no players with major market share (highly fragmented). This is why Chris Bennett has gone on to raise over $24 million to date from Andreessen Horowitz and others for Wonderschool to go after the market by building a platform for in-home preschools and daycares. If Wonderschool can capture even 2% of the market, that equates to over $1 billion in annual revenue which is significant.

According to the Bureau of Economic Analysis, the total employee construction compensation in the United States in 2017 was over $517 billion. That number is up over 150% since 2010. Despite the dramatic increase in earning potential, there is an acute labor shortage in the construction workforce. There is clearly an opportunity to go after a huge market opportunity if someone can figure out how to identify or create labor supply for the construction market. That is how you get to a billion dollar valuation.

Do your homework and research the publicly available data on your audience. Here are three publicly available sources that I use to research audiences:

- The Bureau of Labor Statistics is a great (and free) resource to gauge the size of your target market.

- Statista is a premium portal for statistics that aggregates data on different industries. They’ve already put together all the charts and analysis you’ll ever need by industry.

- The Bureau of Economic Analysis, part of the U.S. Chamber of Commerce, is another free resource to research different industries. This awesome interactive tool allows you to look at G.D.P. value added by industry.

Anand Iyer has collected more super helpful resources on market sizing.

2. Is it a Crowded Space?

Go After Undesirable, Neglected Industries

Many ideas coming from Silicon Valley are from people solving their own Silicon Valley problems. It’s the reason why there are dozens of marketing automation companies, engineering bug tracking companies, and project management companies. This not to say that you cannot be wildly successful if you build the next big CRM or the next hot design collaboration company, because if you can beat out all of the others to seriously take on Salesforce or Slack, then you deserve all the success. Most entrepreneurs build solutions for the pain and challenges that they experience in their daily lives. Therefore it’s inevitable a lot of tech companies are solving the founder’s own problems. As a result, the competition is fierce in crowded spaces like marketing, engineering and sales software. If you want to improve your odds of success, you need to think outside of the Valley.

There’s a whole world outside of the tech bubble where people aren’t struggling with the same problems. Farmers, truckers, retail and restaurant workers, government, construction, and the list goes on and on. For example, you know what’s a big industry? Death. People die every day and have to be buried or cremated. That’s a big business and the AOV is in the hundreds to thousands of dollars. The average cost of human cremation in the US is $1,100. Tulip Cremation is innovating in the cremation space and is doing quite well. Hopefully for their customers (not for Tulip), the frequency of transaction and retention is low!

3. Is it Ripe for Modernization?

Teaching an Old Dog New Tricks

One way to know if there is a huge market opportunity is to identify long standing business processes in an industry. Is there a process that can be disrupted by a better offering powered by technology and innovation? I’ll call this the “That’s how it’s always been done” opportunity. If you can identify a critical or high volume transaction or process in a big industry that is outdated and badly in need of improvement (speed, convenience, quality, etc.), you may have also identified a gold mine.

Growing up, my mother had her own freight forwarding company in New York. I helped her out during the summers and learned about processing bills of lading and coordinating shipping containers with phone calls and faxes. That was in the early 1990s. My mom continued to run that business until she retired and it hadn’t innovated very much in that time. She still interacted with the same contacts at the major shipping companies, but she could never efficiently get pricing quotes from all of the freight companies because it was such a manual process. Flexport was founded by Ryan Petersen in 2013 and changed all of that. Flexport has now raised over $1 billion to modernize the freight forwarding industry…in just six years.

Imagine how many other industries there are that have business practices that have yet to be modernized. Law firms and consulting firms that essentially have partners that sell work and delegate to their employees while they take a large cut for being the broker dealer. Agents in Hollywood that represent actors and actresses to find them gigs and charge significant fees for access. It’s how lawyers, consultants and actors have been getting work for ages. But who says that’s how it always has to be? These are all broker dealer models that are essentially lead generation for different industries and are waiting to be displaced by the right marketplace technologies.

It isn’t easy to fight generations of accepted business practices. It’s even harder if you’re an outsider. My suggestion is to partner with someone who is a domain expert in the industry and has existing connections and credibility. That way it’s easier to gain trust and win over key players. If you can prove your solution is effective on a small scale, then others will be forced to follow or be left behind.

Atrium is doing this in the legal industry by creating a new type of law firm powered by technology with transparent pricing. Justin Kan partnered with an existing law firm to solve this problem. Atrium is addressing two of the biggest complaints for clients, that law firms are slow and overcharge. Instead of being a black box where clients get an invoice with a bunch of billable hours logged that leaves you scratching your head (really? it took you 4 hours to write that email?), clients now have a better understanding of what they are paying for. Atrium is creating accountability and transparency in an industry that has never had it before. That’s just how it’s always been done.

Sometimes you can just bypass the old guard entirely. Opendoor is shaking up the real estate industry by allowing people to liquidate their homes instantly in order to purchase a new home. Instead of having to spend time and money on an agent waiting weeks or possibly months to sell in order to have cash to put towards a down payment on a new home (how it’s always been done), a homeowner can sell their home to Opendoor and have that cash in less than a week. Opendoor didn’t have to appease the existing real estate incumbents in order to get into the game, they simply took them out of the equation by becoming the buyer themselves. They are literally changing the game.

4. Can You Be Easily Disintermediated?

Gaming the System

The headhunting industry is very attractive because of the high AOV (traditionally 20–30% of first year salary and can get as high as six-figures for an executive). For that same reason, it is also an extremely crowded space with recruiting marketplaces like Hired, Triplebyte, Vettery, A-List by AngelList and countless others. The challenge is that employers will find a way to bypass you to avoid paying the hefty bounty. When you find a promising candidate on the platform, the easiest workaround is to download their resume and find their email address if is hasn’t been obfuscated or redacted. It’s just as easy to reach them if they share a LinkedIn profile or personal website.

Recruiting companies try to avoid disintermediation by offering a signing bonus to disincentivize a candidate from working around them. But an employer could easily offer them a much bigger signing bonus from the savings of avoiding the bounty payment. The only viable way to keep people from skirting the marketplace is to build products and features that make it far more inconvenient or costly to do otherwise. If you can’t create stickiness or loyalty, then you better have a good way of plugging your holes.

The biggest challenge for most recruiting startups is knowing if a candidate has accepted a job and completed the transaction. The power of AngelList is that they can confirm it because candidates update their personal AngelList profile. AngelList sends us a bill immediately once a candidate updates their work history with their new job at Pared. No other recruiting company has that power of verification with the exception of LinkedIn. Competitors would have to monitor every candidate’s LinkedIn profile for updates without any API access (LinkedIn cut off most partners years ago). Even then it’s nearly impossible to automate unless they scrape which violates LinkedIn policies. LinkedIn could have gone with the Hired model, but instead has monetized higher up the funnel with LinkedIn Recruiter to gain search access to profile data to find qualified candidates and not worry about disintermediation. Very few companies have the scale and critical mass of profiles to make this valuable enough to an employer to charge for access at the top of the funnel.

Another example of disintermediation happens in designer marketplaces. When I used a service like Dribbble, where I could see portfolios of designers, I would pull up their websites or resumes and email them directly instead of paying for a subscription to DM the designers. On Upwork, however, it was very difficult to convince an animator I worked with to go off platform and work with me directly. Upwork had all of the contracts and agreements on the platform to protect the work or payment of the contractor. They also wanted to continue to build their reputation on the platform, so they were less incentivized to go off network and miss out on capturing that valuable positive feedback. Upwork created a sense of security, convenience and identity that they would relinquish by going around the marketplace. The upside wasn’t worth the downside. If you create valuable tools and products for your supply, you will see less churn.

As an investor, you need to determine the ease of which a participant in the marketplace can convince a provider or supplier to transact outside of the platform before you write a check. Otherwise, you may end up putting money into a leaky bucket.

Pared has users that speak multiple languages, so I often find myself needing translations. I use a translation service called Gengo, which allows you to submit text to a marketplace of translators around the world that can return your translation in a matter of hours. Because I’m optimizing for speed and the translators are relatively interchangeable like Uber drivers, I have no desire to disintermediate or go around the system. This is the advantage of a marketplace where the individual provider is less important than the access to the entire network of providers. Uber and Gengo have blind matching which means it’s a supply-picks model that makes it nearly impossible to circumvent. I want access to the network of translators and rideshare drivers, not just one specific person because I don’t need a personal translator or driver all the time. Compare this to the designer or babysitter that I really like and specifically want to work with again in the future and will do my best to take off the marketplace.

5. Is the Revenue Model Viable?

Does the Math Add Up

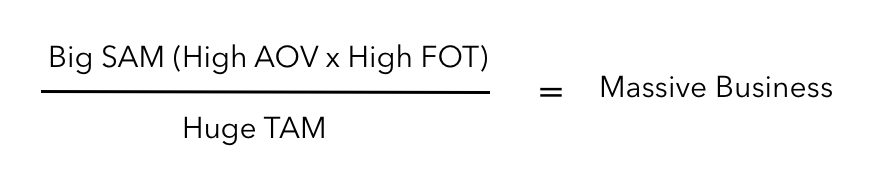

When you start any business you have to think about revenue potential. Business 101: Potential revenue is a function of P (price) and Q (quantity). You can only build a big business if you have a high frequency of transaction (FOT) or average order value (AOV). Your upper bound is limited by your TAM and more relevantly by your SAM.

If you are leaving your job to start a company that sells something that a person only needs one time and only costs $1, you might want to reconsider. The same is true if you can sell something for $100,000 but there are only 5 buyers in the world. If you create a service that someone is willing to pay $10,000 per job placement like Hired or takes 200 rides a year on like Uber, then you have a potentially huge business. Going back to the example of construction, if you can monetize contracts for construction workers, that is a very high AOV in a very big industry. If they can get multiple contracts over the course of the year with all of the current demand for building projects, that increases the FOT. Having one or the other is great, but having both is phenomenal.

It is important to understand how you will monetize your marketplace. Will you have a subscription or pay-per-transaction model. Depending on your use case, you want to make sure you choose the right business model. If disintermediation is likely later on in the funnel, then charging a subscription for access earlier on in the funnel (a la LinkedIn) is probably a safer bet. If you expect ongoing long-term engagement, you may want to consider a subscription model with a discount because you’re locking in revenue.

Remember, just because you have a high AOV or FOT, if your customer acquisition cost (CAC) is too high, it might not matter. If you can get someone to pay $500 per transaction but you need a field sales team to go door-to-door and take that potential customer to dinner to close them, then the math probably won’t work out (unless the conversion rate is extremely high and they are going to In N’ Out for dinner).

6. Are there things you can leverage to grow and scale?

Look for Turbo Boosts

It’s really hard starting a marketplace from scratch. When I play Mario Kart with my nephews, I’m always looking for turbo boosts to give me the speed to help me win. Many consumer marketplaces are insanely challenging to build because you have to create both supply and demand for something that never existed before. You are trying to create new behaviors which is inherently difficult to do. Finding force multipliers to help you grow and scale either supply or demand acquisition can help drive success.

We started Pared, a labor marketplace for hospitality, because my cofounder knew that staffing was the bane of his existence as a restaurant operator. The current solutions have not changed dramatically: posting to classifieds whether it was in the local paper a hundred years ago or on Craigslist today. We thought that there had to be a better way. Because the hospitality industry is so well connected and networked, we could leverage the existing networkto acquire supply and demand faster. Industry standards like food handlers licenses also allowed us to identify and filter supply better and faster. Delivery companies are able to take advantage of turbo boosts like national restaurant chains and franchises to expand rapidly and grow their footprints with partnership like Doordash did with Cheesecake Factory and Uber Eats did with McDonald’s. Legislation can also be leveraged drive growth in demand or supply. Scooter companies such as Skip and Scoot in San Francisco were able to block competition from Lime (ironically headquartered here) and Bird with the help of municipal decisions. Look for industries where turbo boosts such as existing networks, industry standards and certifications, national and regional chains or franchises and legislation can accelerate your growth trajectory and understand how to take advantage of them.