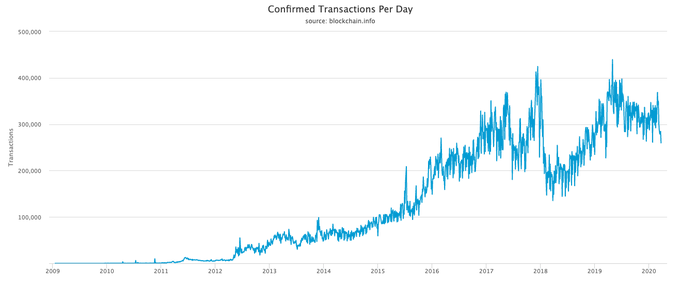

Blockchain was first introduced by Satoshi Nakamoto with her/his/their article “Bitcoin: A Peer-to-Peer Electronic Cash System” published on October 31, 2008 (although… interestingly enough, Satoshi Nakamoto never used the word “blockchain” in the white paper). Hundreds of millions of transactions have since been implemented on it. This is me being sarcastic on Twitter:

Confirmed #Bitcoin transactions per day.

In total: almost 520 million.

But sure, it’s just a “passing fad”.

Needless to say, such a craze couldn’t possibly go without litigation. While most conflicts are being settled within the blockchain ecosystems (see “The DAO incident,” in 2016), I decided to take a closer look and analyze the 320 cases in the United States mentioning “blockchain” OR “bitcoin” OR “cryptocurrency” that are listed on WestLawNext for the past decade. Here are some big data to start with, listing the number of cases per year:

Now, that’s what I call a rise! Interestingly enough, the number of cases has increased only slightly until 2018, even though 287 million transactions had already taken place on the Bitcoin blockchain at the end of 2017, and 117 million on the Ethereum blockchain. It confirms (the initial) blockchain communities’ strong dislike for the state system (here, state justice). The spirit of John Perry Barlow’s “A Declaration of the Independence of Cyberspace,” has been very well alive. As he said indeed: “Governments derive their just powers from the consent of the governed. You have neither solicited nor received ours. We did not invite you.”

Ten years from now, I bet that a similar article will include all the litigation settled by blockchain using services such as Aragon Court and Kleros. But for now, back to our subject. For those of you exclusively interested in crypto-currencies, here is, among all 320 litigation, the distribution of the (public) disputes per crypto-currency:

Am I surprised by the results? To some degree, Bitcoin has attracted lots of attention during the past decade, and one should expect the many scams that come with it. And yet, I was expecting more litigation regarding smart contracts and “unstoppable code” (see page 120) related issues. I see two possibilities in that regard: (i) it’s too soon, or (ii) the fact that blockchain code is unstoppable has discouraged legal action, making the parties aware of the difficulties in applying the law (for more on that, you may want to read this article). As a famous philosopher said one day: only time will tell.

In any case, let us dive into these 320 cases. Here’s a first overview of the legal issues that were at stake:

Civil matters are KING. One could have expected more on the side of criminal activities, but let us remember that they are (way) harder to detect on blockchain than they are in the outside world. I am not even discussing the ability to stop them (see that article for more on the subject). As for securities, I find it quite interesting to know that they represent “only” 23% of all litigation, considering the fact that they are the center of most regulations.

Evidently, one category has caught my attention: the one WestLawNext calls “antitrust.” I have renamed it “unfair practices” for reasons that I explain right below, but first, here’s a panorama of related litigation over the last ten years:

As one can see, the increase is more recent than what it has been for other types of litigation. But what does this category include anyway? Well, 32 of these cases are concerned with issues of fraud, 12 with securities, 7 trademarks, and 12 with unfair competition. This last category includes 8 cases mentioning Section 5(a) of the FTC Act which, as you know, is used in antitrust matters (Section 5(a) of the FTC Act provides that “unfair or deceptive acts or practices in or affecting commerce . . . are . . . declared unlawful.”).

The others concern “unfair competition under the Lanham Act,” or disputes brought on the basis of California’s Unfair Competition Law. Let us remember here that “[t]o assert a claim under the UCL’s unlawful prong, the plaintiff must allege a violation of another law. To assert a claim under UCL’s unfair prong, the plaintiff may allege conduct that threatens an incipient violation of an antitrust law, or violates the policy or spirit of one of those laws because its effects are comparable to or the same as a violation of the law, or otherwise significantly threatens or harms competition, see Cel-Tech Commc’ns, Inc. v. Los Angeles Cellular Tel. Co., 20 Cal. 4th 163, 187 (1999).” We are getting closer to our subject of choice: antitrust.

In fact, when looking at it more closely, one may find one case dealing with a non-compete clause (Scott v. Grens, 2019 IL App (1st) 181527-U) and a few others touching upon issues more or less related the Sherman Act. I will discuss that very soon with an article to be published on the Concurrentialiste. In the meantime, let us emphasize that the number of antitrust litigation remains quite low, but the trend is upwards, as it was for civil and criminal cases a few years ago. Let’s get ready. You can start here if you want ; ) : https://blockchainantitrust.com/