Despite the most challenging year on record for anyone in publishing or digital advertising (and other sectors, of course), the European digital advertising market still managed to grow an astonishing 6.3 percent during 2020, culminating in a market value of €69bn. Figures out today from IAB Europe show that declines in ad spend were restricted to Q2, at the height of home lockdowns, before recovering rapidly in Q3 followed by double-digit growth in Q4.

The findings, which form part of IAB Europe’s AdEx 2020 report, also showed that digital’s share of media advertising increased in all markets, typically by mid-single percentage points, as other media channels suffered. Digital advertising now commands more than 50% of all media ad spend in 13 out of 28 markets included in the IAB’s study.

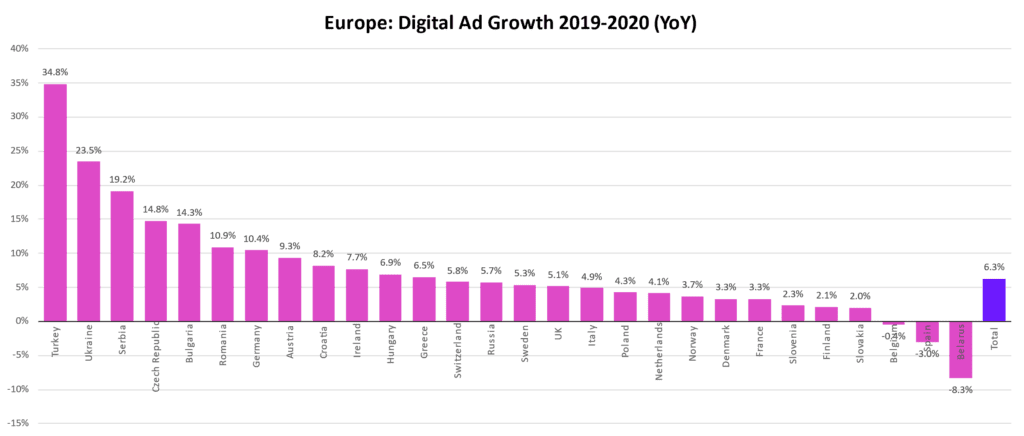

Turkey led European digital advertising growth with 34.8% vs 2019, followed by other Central European markets. The fastest-growing Western European market was Germany, up 10.4%. The UK came in with a respectable 5.1% growth. Only Belgium, Spain and Belarus saw overall declines.

Other key findings include:

- Digital Ad spend per capita was €87 on average, with UK (€338) and Sweden (€260) topping the list.

- Growth in 2020 varied by format: Display outperformed the market (+9.1%), followed by Paid-for Search (+7.8%). Classifieds, Directories and Affiliates declined (-9.1%).

- Display was driven by video (+16.3%) and social (+16.5%).

- Excluding social, programmatic was a key growth driver (+8.3%) as non-programmatic spend declined (-2.7%).

- Video now commands 39.4% of all display spend and exceeds 50% in 4 markets.

- Digital Audio advertising is growing fast (+16.7%) from a small base. It is nascent in terms of market size with €500m spent across the markets under study, or 1.6% of all display spend.

Dr. Daniel Knapp, Chief Economist, IAB Europe, who compiled and presented the study commented, “Digital advertising did not have a bad year in 2020, only a bad quarter. We saw rapid recovery already setting in in Q3 before double-digit growth in Q4. A strong reliance on performance channels during the height of lockdown was complemented with a fast redeployment of branding activity, in particular through digital video.

“The events of 2020 have fast-forwarded long-term socio-economic transformations that are altering how people consume and how companies operate. This provides a fertile ground for digital advertising and we expect the sector to accelerate its growth in 2021.”

The full AdEx Benchmark Report can be accessed here.

IAB Europe’s Economic Trends Forum special on the 8th July will dive into the newly released AdEx Report– the European reference study for digital advertising spend – to look at key digital ad spends and trends in 2020. Measured against the severity of the COVID-19 outbreak and subsequent economic deterioration, Daniel Knapp will provide a meta-analysis of 2020 ad spend data submitted from the 28 European countries to provide a harmonised, like-for-like comparison across digital dynamics and formats in European ad markets. This live event will feature an audience Q&A session, following Knapp’s presentation. Register here to secure your free place.